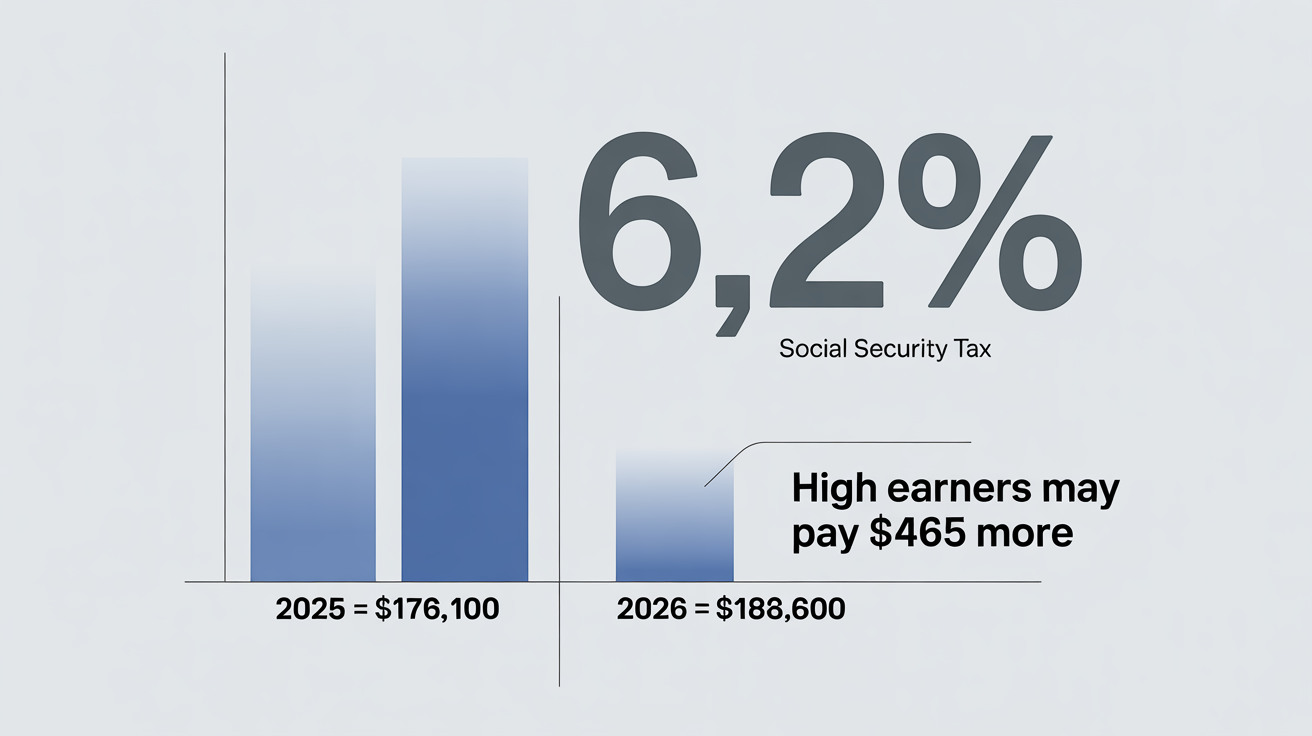

3. The Social Security Tax Cap Is Rising

If you’re still working, or if you have kids and grandkids in the workforce, here’s a change that affects paychecks. Social Security is funded by payroll taxes, and there’s a cap on how much income is taxed each year. In 2025, that cap is $176,100. In 2026, it’s expected to rise to about $183,600.

That means workers will pay the 6.2% Social Security tax on earnings up to that higher amount. For high earners, this could mean paying about $465 more in Social Security taxes next year. For the average worker, this doesn’t change much, since most people earn less than the cap. But it’s worth noting, because raising the wage base is one of the ways Social Security tries to keep the program funded.