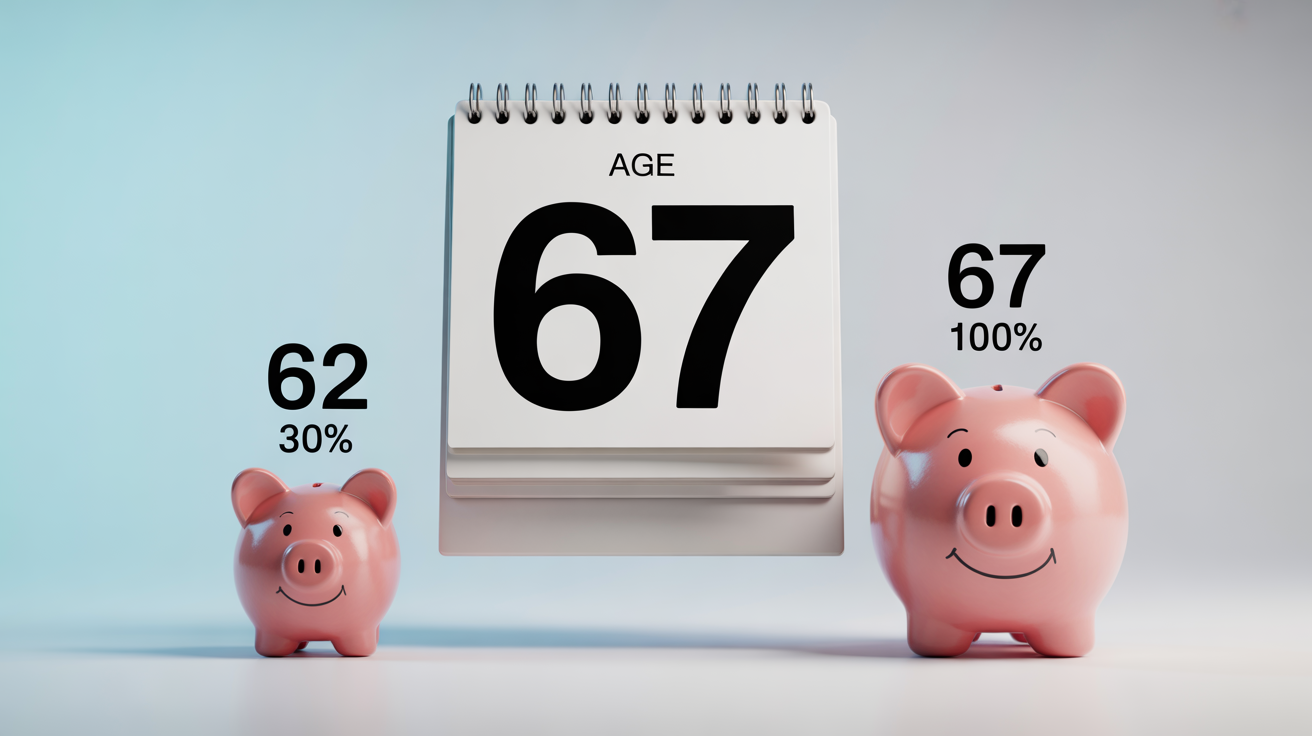

2. Full Retirement Age (FRA) Officially Reaches 67

This is a big milestone. For those born in 1960 or later, the full retirement age—the age at which you get 100% of your Social Security benefits—will now be 67 years old.

Why does this matter? If you choose to take your benefits early, say at age 62, your monthly checks will be permanently reduced—by up to 30%. That’s a big cut, especially if Social Security is your main source of income. On the flip side, if you can wait until age 67, you’ll receive the full benefit you’ve earned over your lifetime. And if you’re able to wait even longer, up to age 70, your benefits grow a bit more each year.

If you’re approaching retirement, this is the time to run the numbers: Can you afford to wait? Do you need the money sooner? Sometimes taking early benefits makes sense, but knowing the trade-offs helps you make the best decision for your situation.