1. A Modest Cost-of-Living Adjustment (COLA)

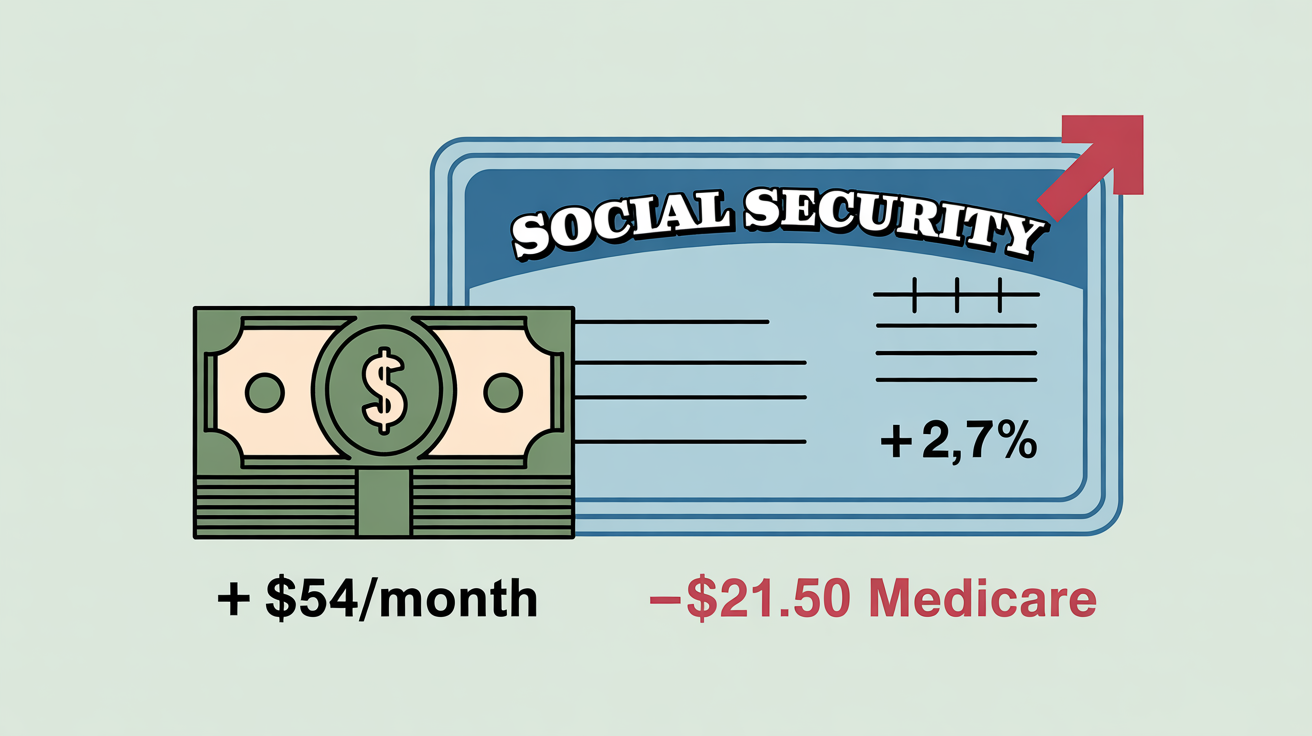

Every fall, Social Security announces the cost-of-living adjustment, or COLA, which is meant to keep your benefits in step with inflation. For 2026, the adjustment is expected to be about 2.7%. That’s a bit higher than the 2.5% bump in 2025, but still far less than the record increases we saw after the pandemic when inflation was sky-high.

So, what does this mean in real life? For the average retiree getting about $2,006 per month, this translates to about $54 extra each month. That may sound nice, but here’s the catch: Medicare Part B premiums are also expected to rise—by about $21.50 per month. So, if you’re on Medicare, that COLA will shrink quickly once those premiums are deducted.

The bottom line: expect a small raise, but don’t count on it stretching very far. This is a reminder to keep an eye on your budget, especially when it comes to medical expenses and groceries, which often outpace COLA increases.