4. Higher Earnings Limits for Those Who Work While Collecting

Many retirees choose to keep working part-time while also collecting Social Security. If that’s you, pay close attention here, because there are rules about how much you can earn before it affects your benefits.

-

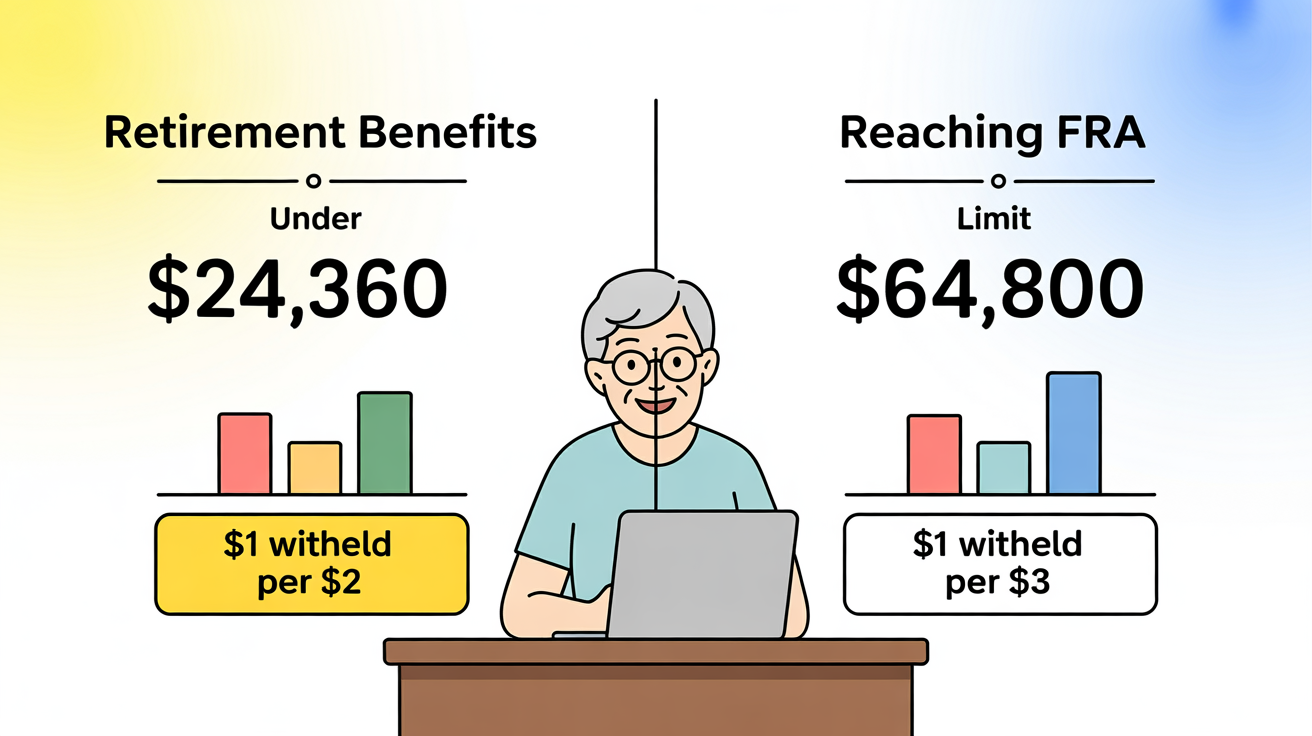

If you’re under your full retirement age (which will be 67 in 2026), the earnings limit is expected to rise to about $24,360. If you make more than that, Social Security will withhold $1 from your benefits for every $2 you earn above the limit.

-

If you’ll reach full retirement age in 2026, the limit is higher—about $64,800—and the penalty is lighter: $1 withheld for every $3 you earn above the limit, up until the month you turn 67.

-

Once you’ve hit full retirement age, there’s no limit. You can work and earn as much as you want without worrying about reductions.

This rule often confuses people, but here’s some good news: if Social Security withholds part of your benefit now, it isn’t lost forever. They adjust your benefit later to account for it. Still, it’s smart to know the numbers so you don’t get surprised.