“I’m Anxious Even When I Pay My Bills”

You’re not alone.

So many people who should feel okay financially don’t. They pay their bills on time, they keep up with payments, they have stable income — and yet, that feeling of worry never fully goes away.

You know how to do money,

but you still feel like money might slip away.

You scroll your banking app at night.

You check due dates over and over.

You wake up briefly wondering whether a bill cleared.

And when that anxiety quiets for a moment — it’s only because another due date is coming.

This isn’t bad math.

It’s chronic uncertainty.

And the surprising truth is:

most money anxiety isn’t about how much you owe.

It’s about not knowing exactly when money leaves your control.

That’s why the only fix that consistently helps isn’t another savings challenge or finance motivation article — it’s a simple system that gives you clarity, predictability, and breathing room: a bill calendar with buffer timing.

This setup removes the fear of never knowing when payments are coming. It turns financial maintenance into a rhythm you can trust, not fear.

Why Paying Your Bills Doesn’t Stop Anxiety

You would think that once bills are paid on time, the stress should disappear. But for many Americans — especially those living paycheck to paycheck or with a tight cash flow — that anxiety doesn’t simply go away.

Here’s the reality:

-

You pay bills, but you never feel a financial margin.

Margins are what protect peace of mind. -

You track expenses, but you still wonder if something will go wrong.

Because you’ve survived setbacks before. -

Your brain remembers the financial “almost misses.”

Not the times when everything went smoothly.

So even good financial behavior doesn’t create confidence. It only prevents disaster. And living in “just not disaster” mode still feels stressful.

That’s why anxiety persists — even when you do everything “right.”

The Root Cause: Uncertainty, Not Math

Financial anxiety isn’t simply about payments or amounts. It comes down to uncertainty over timing.

When money feels like it’s constantly slipping away, your nervous system stays on alert. You’re always checking accounts, double-checking dates, re-calculating whether something might be late, or whether you have enough.

Even when you do have enough.

This happens because your brain doesn’t just worry about what you owe. It worries about when your money is going to leave your control — especially when:

-

automatic payments don’t sync with paychecks,

-

bills are scattered across different dates,

-

and incoming money doesn’t line up cleanly.

That mismatch, even if it’s small, creates chronic anticipation — the feeling that you’re always one step away from being stuck.

Why Other Advice Falls Short

You may have read things like:

-

“Just save more.”

-

“Track every expense.”

-

“Build an emergency fund.”

All of those can help — eventually.

But they miss the real trigger for your anxiety:

The fear isn’t about whether you have money.

It’s about whether the timing of money will betray you.

You could have $5,000 in savings and still feel anxious if:

-

your paycheck arrives after bills are due,

-

your automatic payments clear before your income posts,

-

or your cash flow doesn’t feel predictable.

That’s not a savings problem.

It’s a timing problem.

The One Fix That Actually Helps: A Bill Calendar + Buffer Timing

Here’s the good news:

You can significantly reduce money anxiety — regardless of income level — by aligning when you get paid with when money leaves your account.

This is done through a bill calendar combined with buffer timing — and it gives you three things you didn’t have before:

-

Clarity — you always know what’s coming.

-

Control — you decide when money moves.

-

Margin — financial space before payments.

Let’s break it down.

Step 1 — List Every Regular Payment

Start by listing every recurring payment you have:

-

Rent or mortgage

-

Utilities

-

Phone bill

-

Insurance

-

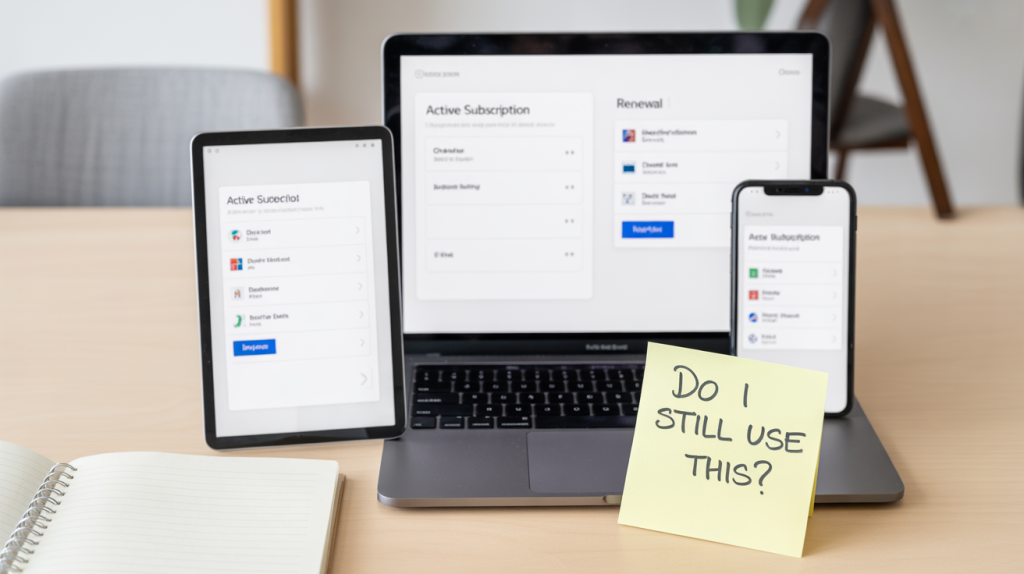

Subscriptions

-

Loan payments

-

Credit cards

-

Savings transfers

-

Anything that leaves your account regularly

Write down:

-

What it is

-

How much it is

-

The date it’s due

-

How it’s paid (auto or manual)

This gives you the full landscape, not just what you remember.

Step 2 — Build a Bill Calendar

Now, put these dates on a visual calendar — digital or paper.

Many people use:

-

Google Calendar (with reminders)

-

A spreadsheet

-

A wall calendar

-

A finance planner app

Arrange payments by date so you see exactly where your money needs to go through the month.

The goal isn’t perfection.

It’s visibility.

When you can see all upcoming payments in one place, your brain stops guessing — and guessing is the root of anxiety.

Step 3 — Add Buffer Timing

Here’s where the system becomes powerful.

Buffer timing means you schedule payments after your income arrives — not before.

Example:

Your paycheck arrives on the 1st and the 15th of the month.

Instead of letting bills clear whenever:

-

Move payments due on the 3rd, 4th, 5th, etc. to the 5th

-

Move payments due on the 16th, 17th, 18th, etc. to the 18th

Why?

Because you create time between receiving money and paying bills.

That buffer is what gives peace of mind.

You’re no longer living with the fear that money will disappear before you even get to use it.

Step 4 — Automate Thoughtfully

Automation can be a friend if you control the timing.

Set up:

-

auto-payments to align with your buffer dates

-

reminders 3–5 days before bills clear

-

alerts for when money lands in your account

But don’t automate blindly.

The power is in alignment, not automation alone.

Step 5 — Monthly Check-Ins

Once your bill calendar and buffer system are in place, do a monthly check-in:

-

Confirm dates for the next month

-

Adjust for any changes

-

Notice where your cash flow feels roomy or tight

This isn’t a chore. It’s a confidence builder.

When you check in once a month, your brain doesn’t feel like it has to monitor money every day.

That’s the transition from anxiety to assurance.

What This Actually Feels Like in Real Life

At first, doing this feels like organization.

But over time, it creates something deeper:

-

You stop opening your banking app anxiously.

-

You don’t dread days around payment dates.

-

You sleep better knowing the system has your back.

-

You feel in control, not reactive.

This isn’t about money size — it’s about money timing and predictability.

And predictability is the antidote to fear.

Real Savings for Real People

By aligning payments and creating buffers:

-

You reduce overdraft risk

-

You reduce late fees

-

You reduce stress

-

You stop feeling like money is a countdown

Many people find that this simple clarity frees up mental space that feels as valuable as savings.

Because anxiety is a cost — even if it isn’t written in dollars.

Common Mistakes to Avoid

🚫 Not accounting for variable income

If your income changes week to week, schedule buffer dates based on your lowest expected month. This gives you breathing room.

🚫 Forgetting irregular expenses

Remember quarterly or annual expenses? Add them to your calendar so they don’t sneak up on you.

🚫 Ignoring reminders

The system only works if you check it. Set alerts — and respect them.

The Bigger Truth About Financial Confidence

Most financial advice focuses on math:

-

save more

-

spend less

-

track every dollar

Those things matter.

But real confidence isn’t about numbers.

It’s about predictability.

When you know where your money goes — and when — you stop living in fear of surprise charges, late payments, and awkward budget gaps.

That peace — that predictability — is the real fix that actually helps.

You Don’t Need Perfect Finances — You Need Predictable Ones

Financial confidence doesn’t require perfect budgets, zero debt, or big income.

It requires clarity.

You don’t have to eliminate anxiety.

You just need to contain it.

A bill calendar with buffer timing doesn’t solve every money problem — but it solves the fear of the unknown, and that is where most money anxiety begins.

Paying bills can be stressful.

Not knowing when you’ll pay them is worse.

This system changes that.

And that’s the difference between managing money and feeling at peace with it.

Read next: The Middle-Class Money Stress No One Talks About