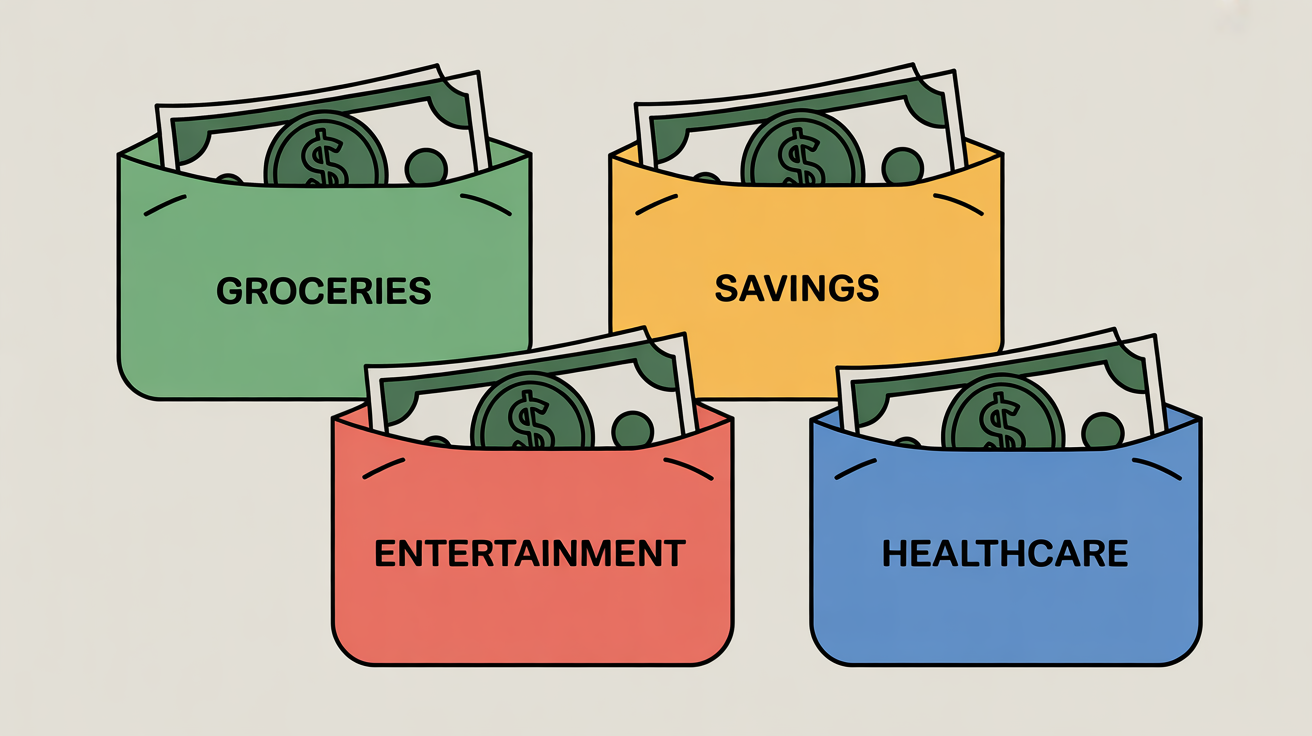

Step 3: Assign Every Dollar a Job

This step is the heart of the method. You don’t leave a single dollar unplanned. Even if you want to put money aside “just in case,” you still give it a job. For example, “extra cushion” or “future repairs.”

The idea is that when you look at your budget, you’ll know exactly:

-

How much is going to bills,

-

How much is saved, and

-

How much is left for you to enjoy.

It’s a bit like lining up chairs for a family gathering—everyone gets a seat, and there are no extras left standing around.