10 Money Habits of People Who Are Actually Rich

When people hear the word rich, they often picture flashy cars, designer clothes, or lottery-level luck. But in real life, the people who quietly build wealth usually look… surprisingly normal.

They don’t always earn the most.

They don’t flex the hardest.

And they definitely didn’t get rich overnight.

What sets them apart isn’t talent or timing—it’s habits. Small, boring, repeatable money behaviors done consistently over years.

The good news? These habits aren’t reserved for people born into money. They’re learnable. And once you understand how rich people think about money, your financial decisions start changing automatically.

Here are 10 money habits rich people have in common, explained in a way you can actually apply—no yachts required.

1. They Treat Money Like a Tool, Not an Emotion

One of the biggest differences between wealthy people and everyone else is emotional distance from money.

Rich people don’t:

-

Panic when markets dip

-

Feel “guilty” for earning more

-

Spend to soothe boredom, sadness, or stress

Money isn’t tied to their self-worth or mood. It’s a tool—like a hammer or a calculator.

Many people spend emotionally:

-

“I deserve this.”

-

“I’ve had a hard week.”

-

“I’ll worry about it later.”

Wealthy people pause and ask:

“What is this money for?”

That pause alone saves thousands over a lifetime.

How to build this habit:

Before spending, ask: Is this solving a real problem—or just an emotional one?

If it’s emotional, find another outlet. Walk. Write. Call a friend. Don’t swipe.

2. They Pay Themselves First—Automatically

This is one of the oldest wealth rules for a reason: it works.

Rich people don’t save what’s “left over.”

They save first, then live on the rest.

The moment money comes in:

-

A percentage goes to savings

-

A percentage goes to investments

-

A percentage goes to long-term goals

And here’s the key: it’s automated.

No willpower. No monthly debate. No forgetting.

People who struggle financially usually do the opposite:

“I’ll save if there’s anything left at the end of the month.”

There rarely is.

How to build this habit:

Start small—5% or even 2%. Set an automatic transfer the same day your income hits. Increase it slowly. Your future self will thank you.

3. They Track Their Money (Even When They’re Wealthy)

Contrary to the myth, rich people don’t “stop budgeting” once they have money.

They just budget differently.

They know:

-

Where their money comes from

-

Where it goes

-

Which expenses actually improve their life

Tracking doesn’t mean spreadsheets and suffering. It means awareness.

Most people avoid tracking because they’re afraid of what they’ll see. Wealthy people see data as power, not judgment.

How to build this habit:

You don’t need perfection. Track once a week. Or review statements monthly. Awareness alone often reduces overspending by 10–20%.

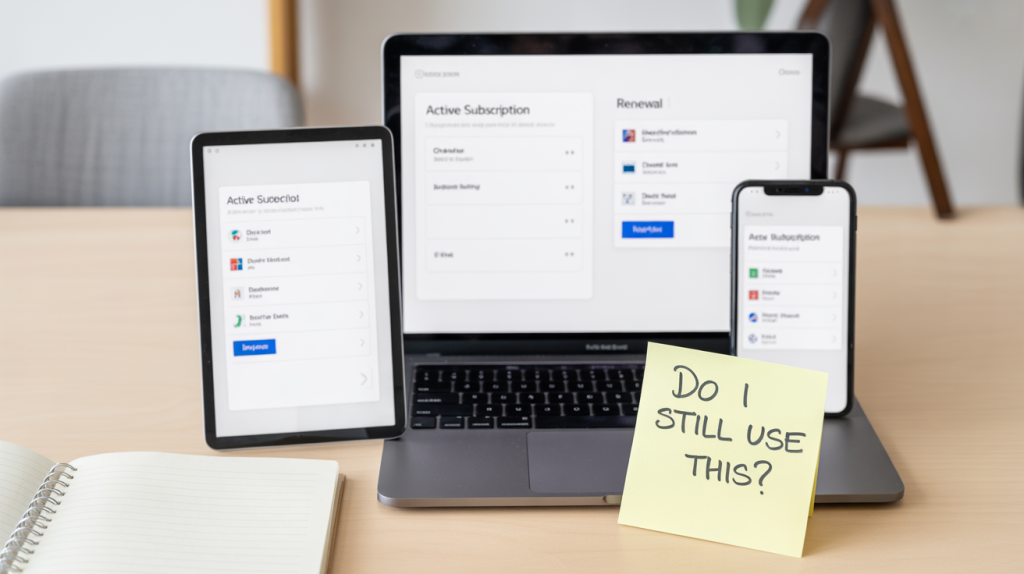

4. They Spend Intentionally—Not Cheaply

Rich people are not cheap. They’re selective.

They’ll happily pay:

-

For quality

-

For time-saving

-

For things that align with their values

And they ruthlessly cut:

-

Convenience spending that adds up

-

Status purchases

-

Things they don’t actually care about

This is why many wealthy people drive modest cars but own appreciating assets.

They don’t ask:

“Is this expensive?”

They ask:

“Is this worth it to me?”

How to build this habit:

Identify your “non-negotiables” (things you love spending on). Spend freely there. Cut without mercy everywhere else.

5. They Don’t Inflate Their Lifestyle With Every Raise

Lifestyle inflation is the silent wealth killer.

Most people earn more → spend more → stay broke.

Rich people earn more → keep most of the increase.

They might upgrade their life slightly, but they don’t let expenses grow at the same speed as income.

That gap—between income growth and spending growth—is where wealth is built.

How to build this habit:

Every time your income increases, lock in at least 50% of the raise for savings, investing, or debt payoff before upgrading anything.

6. They Build Multiple Streams of Income (Slowly)

Wealthy people rarely rely on one source of money forever.

They diversify:

-

Side businesses

-

Freelance work

-

Investments

-

Royalties

-

Rental income

But here’s the truth most gurus skip:

They usually build these one at a time, not all at once.

They start small. Test. Learn. Scale.

How to build this habit:

Instead of asking “How can I get rich fast?” ask:

“What skill, asset, or idea could make me $100 extra a month?”

Then grow from there.

7. They Invest Even When It Feels Boring or Scary

Rich people understand that money grows through exposure, not perfection.

They invest:

-

Before they feel “ready”

-

Before markets feel “safe”

-

Even when headlines are scary

They don’t wait for the perfect moment—because it doesn’t exist.

Many people delay investing for years out of fear. That delay costs more than bad investments ever could.

How to build this habit:

Start with education, then start small. You don’t need genius-level knowledge—just consistency and time.

8. They Think Long-Term, Even When Making Small Decisions

Wealthy people zoom out.

They ask:

-

“What does this decision mean in 5 years?”

-

“Is this helping future me—or stealing from them?”

This doesn’t mean no fun. It means balance.

Impulse spending focuses on now. Wealth focuses on later without sacrificing now completely.

How to build this habit:

Before big purchases, wait 24–72 hours. If you still want it—and it fits your long-term goals—it’s probably a good decision.

9. They Invest in Knowledge Before Status

Rich people spend money on:

-

Skills

-

Books

-

Mentors

-

Courses

-

Information

Before they spend on:

-

Flashy items

-

Status symbols

-

Impressing others

They understand something powerful:

Skills compound faster than possessions.

A new skill can increase income forever. A new gadget usually depreciates immediately.

How to build this habit:

Every year, choose one skill that could increase your income or confidence. Invest in learning it before buying things you don’t need.

10. They Protect Their Money as Much as They Grow It

Being rich isn’t just about making money—it’s about not losing it.

Wealthy people:

-

Have emergency funds

-

Carry proper insurance

-

Avoid reckless risks

-

Plan for downturns

They expect things to go wrong and prepare accordingly.

Most financial disasters happen not from lack of income—but from lack of protection.

How to build this habit:

Start with a basic emergency fund. Even $500–$1,000 can prevent debt spirals. Protection creates peace, and peace leads to better decisions.

Wealth Is Built Quietly

The biggest lie about rich people is that they’re special.

They’re not.

They just repeat a set of habits long enough for the results to look “magical” from the outside.

You don’t need:

-

A huge salary

-

Perfect discipline

-

A finance degree

You need consistent behavior and patience.

Start with one habit from this list. Just one. Build it. Then move to the next.

That’s how real wealth is created—quietly, steadily, and on purpose.

Read next: “I Feel Behind Compared to Everyone Else”