Why This Debt Divide Exists

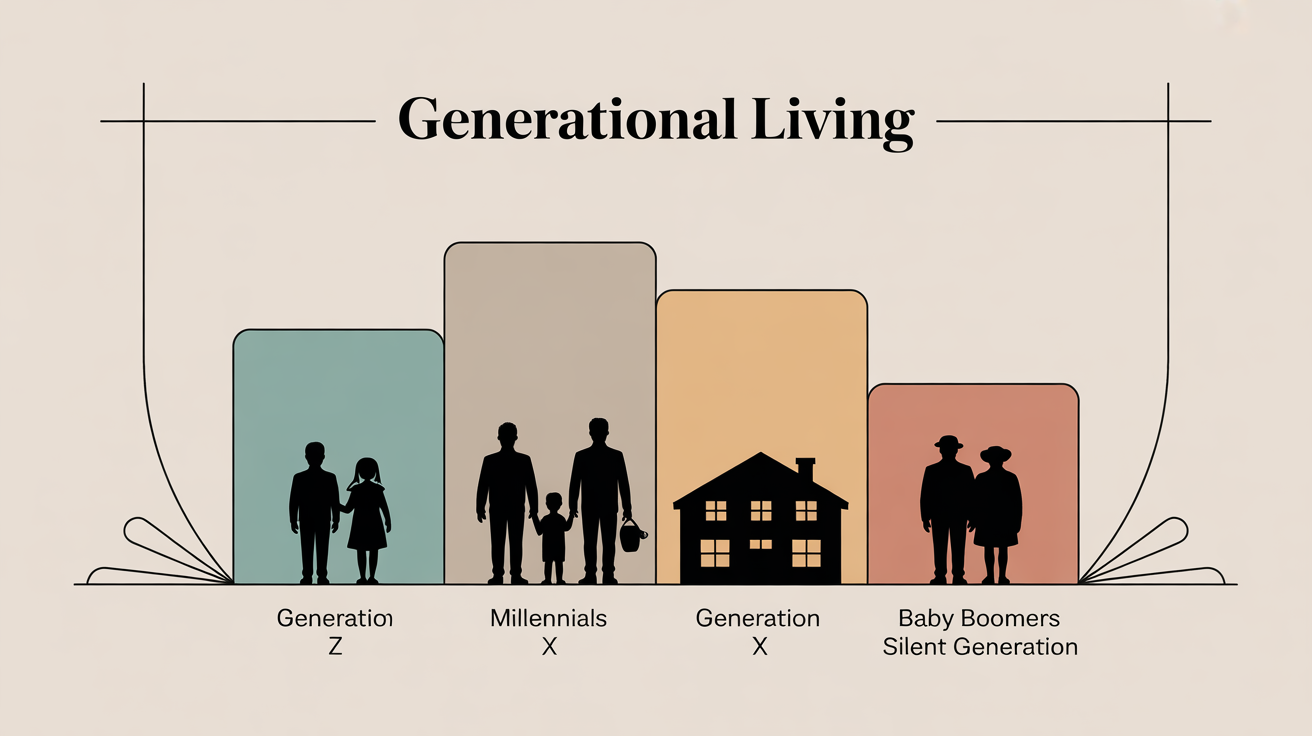

It’s not about who’s “good” or “bad” with money. It’s about life stages.

-

Younger adults are in their building phase: low income, low credit limits, high curiosity.

-

Middle-aged adults are in their expensive years: kids, homes, and caregiving responsibilities.

-

Older adults are in their preservation years: fixed incomes, cautious spending, and less need for credit.

Layer in inflation, housing shortages, student loans, and rising healthcare costs, and it’s easy to see why credit cards have become America’s financial shock absorber.

But just because it’s common doesn’t mean it’s sustainable.