The Hidden Cost of “Just $9.99 a Month

Not long ago, subscriptions felt like a smart deal. For one low monthly price, you could watch unlimited shows, listen to endless music, store files in the cloud, or receive curated products delivered to your door. Subscriptions promised convenience, simplicity, and flexibility—everything modern life seemed to need.

Today, that promise feels much heavier.

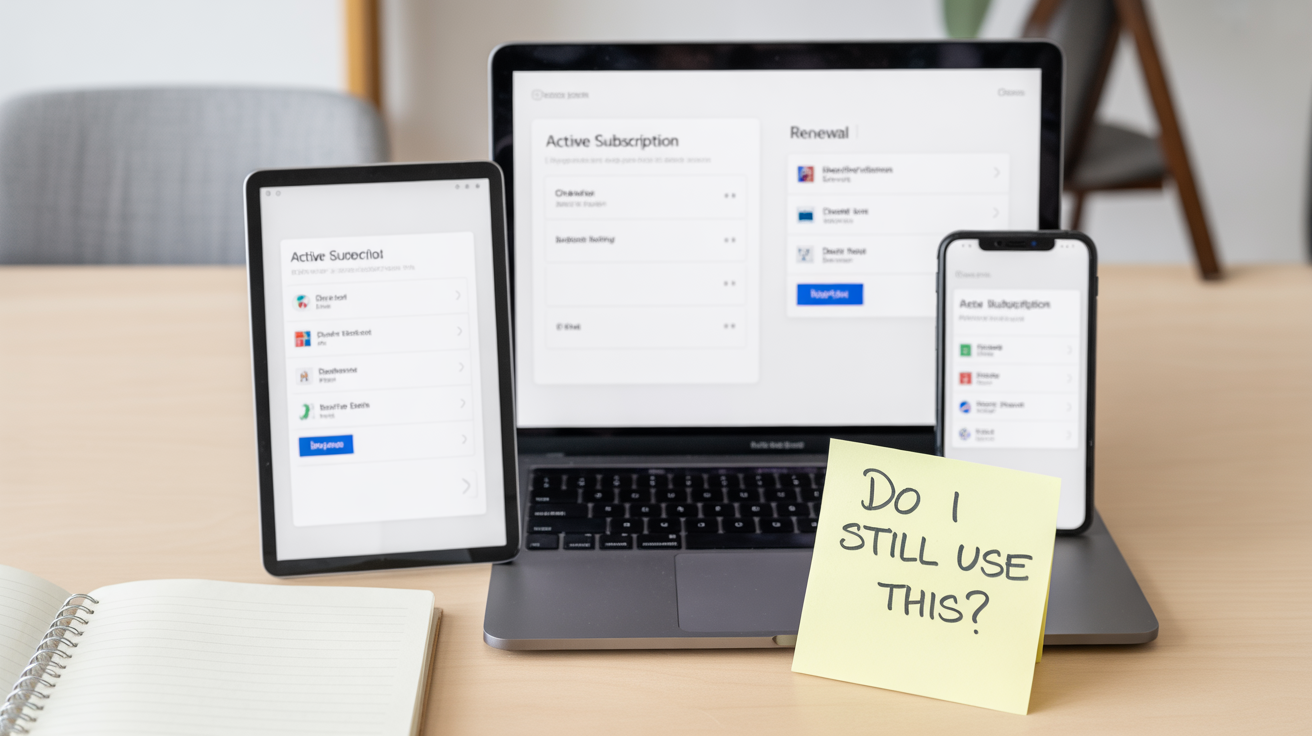

Across the United States, households are quietly paying hundreds of dollars each month for subscriptions they barely notice and rarely use. Streaming platforms, apps, memberships, digital tools, fitness services, and premium features accumulate slowly, blending into bank statements until they feel unavoidable. This growing financial exhaustion has a name: subscription fatigue.

Unlike major expenses such as rent or car payments, subscriptions don’t feel dangerous. They’re small, recurring, and emotionally justified. But together, they’ve become one of the most overlooked drains on American budgets.

How Subscription Culture Took Over Everyday Life

The subscription model didn’t spread by accident. It was designed to feel easy, harmless, and modern.

Instead of paying a large amount upfront, consumers are offered small monthly fees—$9.99 here, $14.99 there. Each individual cost feels insignificant, especially when compared to traditional one-time purchases. Over time, this approach reshaped consumer behavior. People stopped asking, “Do I really need this?” and started asking, “Why not?”

Subscriptions also tap into convenience. Canceling often feels more difficult than signing up. Passwords are forgotten, renewal dates are unclear, and companies rely on the hope that customers won’t bother to unsubscribe. The result is a system where payment continues long after the value has faded.

For many Americans, subscriptions have quietly become a background expense—paid automatically, rarely reviewed, and seldom questioned.

The Illusion of “Small” Monthly Costs

One of the biggest reasons subscription fatigue goes unnoticed is the way these expenses are framed.

A $12 streaming service doesn’t feel like a financial threat. Neither does a $7 app upgrade or a $15 cloud storage plan. But when a household has 10, 15, or even 20 active subscriptions, those “small” costs can add up to $150–$300 per month.

That’s $1,800 to $3,600 per year—often for services that aren’t fully used.

Because these charges are spread out across different platforms and billing cycles, they don’t trigger the same emotional response as a single large bill. They quietly slip through budgets, especially when bank statements are skimmed rather than studied.

Over time, what once felt like convenience turns into financial noise.

Paying for Access, Not Usage

A defining feature of subscription fatigue is the gap between payment and usage.

Many Americans subscribe with good intentions:

-

A fitness app meant to encourage healthier habits

-

A language platform for a future trip

-

A productivity tool for better work organization

But life gets busy. Motivation fades. Interests change.

The subscription, however, remains.

Unlike physical products, subscriptions don’t sit unused on a shelf where they can trigger guilt or awareness. They live invisibly in digital accounts, continuing to charge month after month—even when they haven’t been opened in weeks or months.

This disconnect makes it easy to keep paying without realizing that the service no longer adds value.

The Psychological Traps That Keep Subscriptions Alive

Subscription fatigue isn’t just a budgeting issue—it’s a psychological one.

Many people hesitate to cancel because of:

-

The sunk cost fallacy: “I’ve already paid for it, maybe I’ll use it later.”

-

Fear of losing access: “What if I need it someday?”

-

Decision fatigue: Canceling requires effort, passwords, and attention.

-

Emotional attachment: Subscriptions often represent aspirations—fitness, learning, creativity, productivity.

Companies understand this well. Free trials roll into paid plans automatically. Annual plans feel like savings but reduce flexibility. Bundles make it harder to see what you’re actually using.

The result is a system that quietly encourages inertia.

Streaming Services: The Most Visible (and Still Overlooked) Culprit

Streaming services are often the first place people notice subscription overload, yet even here, costs are underestimated.

Many households subscribe to:

-

Multiple video platforms

-

Music streaming services

-

Ad-free upgrades

-

Premium family plans

Individually, these services seem reasonable. Together, they can exceed $80–$120 per month.

What’s more, streaming habits rarely match subscription levels. Many people rotate between platforms emotionally but pay for them financially all year long. A service may be used intensely for one show, then forgotten—while the charges continue.

Streaming subscriptions feel essential, but they often deliver diminishing returns.

App Subscriptions and “Digital Creep”

Beyond entertainment, app subscriptions have quietly invaded everyday life.

Photo editors, budgeting tools, note-taking apps, meditation platforms, AI tools, fitness trackers, and even weather apps now push monthly or annual plans. What were once one-time purchases are now ongoing financial commitments.

This creates “digital creep”—a slow accumulation of subscriptions that feel too small to notice individually but overwhelming in total.

Because app charges are often processed through app stores, they’re easy to ignore and hard to track without deliberate effort.

Memberships and Services That Outlive Their Purpose

Subscription fatigue also extends into the physical world.

Gym memberships, delivery programs, professional memberships, beauty boxes, and loyalty clubs often continue long after they stop being useful. People move, schedules change, habits evolve—but the payments remain.

Many Americans keep these subscriptions active “just in case,” even when they haven’t used them in months. The emotional cost of canceling often feels higher than the financial cost of continuing—until the numbers are finally added up.

The Opportunity Cost of Subscription Overload

The real damage of subscription fatigue isn’t just wasted money—it’s missed opportunity.

The $200 per month spent on unused services could instead:

-

Build an emergency fund

-

Reduce credit card balances

-

Increase retirement contributions

-

Fund travel or personal goals

Because subscriptions feel small and harmless, they rarely get prioritized in financial conversations. But over time, they quietly crowd out more meaningful uses of money.

Why Subscription Fatigue Feels So Hard to Fix

Subscription fatigue persists because it hides in plain sight.

Payments are automated. Charges feel justified. Life feels busy. And modern culture encourages constant access rather than intentional choice.

Many Americans aren’t careless—they’re overwhelmed. Reviewing subscriptions requires time, clarity, and mental space, which are often in short supply.

Reclaiming Control Without Deprivation

Addressing subscription fatigue doesn’t mean eliminating joy or convenience. It means becoming intentional.

Regularly reviewing subscriptions, pausing instead of canceling when possible, rotating services instead of stacking them, and treating subscriptions as active choices—not defaults—can free up significant financial space.

The goal isn’t perfection. It’s awareness.

Subscription fatigue is one of the most modern financial challenges Americans face. It doesn’t announce itself with crisis or conflict. It simply hums quietly in the background, draining money little by little.

By recognizing how subscriptions accumulate—and how rarely they’re questioned—households can begin to reclaim both money and mental clarity.

In a world built on recurring payments, choosing what truly deserves a recurring place in your budget is a powerful form of financial self-respect.

Read next: Dream Escapes for Your Bucket List This Year (Perfect for the U.S. Traveler — Any Budget)