5. Practical Tips for Making the Most of an HYSA

Here’s where things get interesting: a high-yield savings account isn’t just a place to park money. It can be a powerful tool in your financial strategy if you use it wisely.

Tip 1: Automate Your Savings

Set up automatic transfers from your checking account to your HYSA every payday. Even $50 or $100 per paycheck adds up quickly, and automation makes it painless.

Tip 2: Use It for an Emergency Fund

Every financial expert agrees—you need an emergency fund. A HYSA is perfect for this because it keeps your cash safe, accessible, and growing. Aim for at least 3–6 months’ worth of living expenses.

Tip 3: Separate Goals with Multiple Accounts

Some online banks let you open “sub-accounts” or label different savings buckets. Create one for your emergency fund, one for your vacation, one for holiday shopping, etc. This way you can see your progress clearly and avoid dipping into the wrong funds.

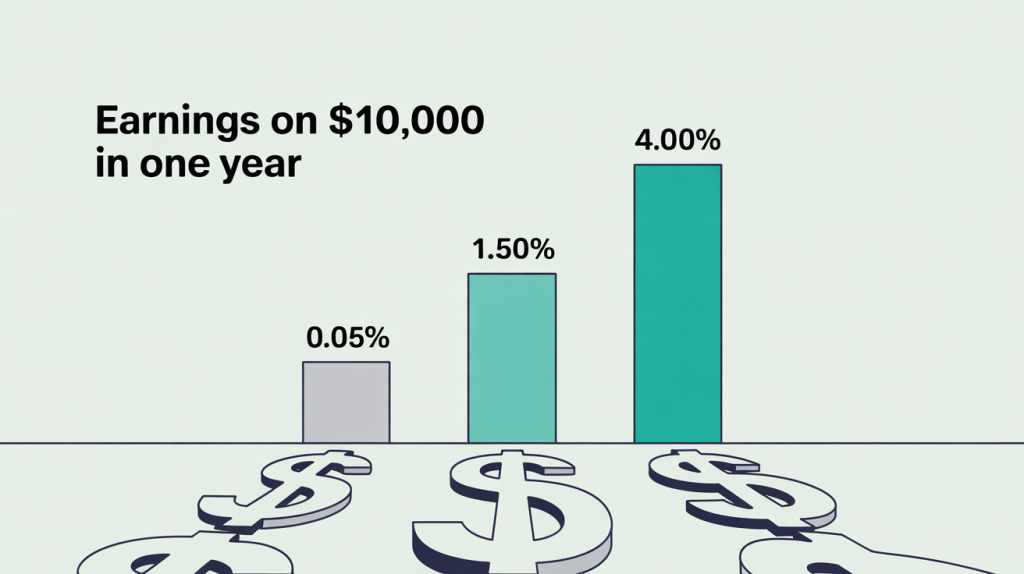

Tip 4: Shop Around for the Best Rates

Rates vary widely. One bank may offer 3.75% while another offers 4.50%. Since most HYSAs are free to open and close, don’t be afraid to move your money to chase better returns.

Tip 5: Pair It with a Checking Account

Some online banks let you connect your HYSA with a high-yield checking account or debit card perks. This combo can streamline your finances while still giving you high returns.

Tip 6: Avoid Temptation

Since the money in your HYSA is meant to grow, don’t treat it like a second checking account. Keep the transfers purposeful—emergencies, specific goals, or savings only.