Always Feel Like You’re Paying Too Much? These 5 Apps Fix That

Overpaying almost never feels intentional.

It doesn’t look like reckless spending or financial irresponsibility. Most of the time, it looks like clicking “Buy Now” because you’re tired, busy, or simply done comparing options after a long day. Modern shopping is built around speed, convenience, and urgency — and those three things are almost always more expensive.

What most people don’t realize is that prices today are fluid, not fixed. The amount you pay depends on timing, location, browser behavior, and even whether a company thinks you’ll bother to look elsewhere. That’s why two people can buy the same item on the same day and pay completely different prices.

The good news? You don’t need to overhaul your lifestyle or become obsessive about saving money. You just need a few smart tools that quietly protect you from paying more than necessary. The apps below don’t judge your spending. They simply level the playing field — and that alone can save hundreds (sometimes thousands) over time.

1. Honey – Automatic Coupons Without the Mental Load

Honey is one of the easiest ways to stop overpaying online, largely because it requires almost no effort after installation. Once added to your browser, it runs silently in the background and activates only when it’s useful — at checkout.

Instead of searching for promo codes that may or may not work, Honey automatically tests dozens of verified codes in seconds. If a discount exists, it finds it. If it doesn’t, you move on knowing you didn’t miss anything. That sense of certainty alone is incredibly valuable.

Beyond coupons, Honey also tracks price changes on items you’re watching. If something drops in price, you’re alerted — which helps prevent the classic mistake of buying too early simply because you didn’t know prices fluctuate.

Why this matters:

Retailers often assume most shoppers won’t look for discounts, especially on mobile or during quick purchases. Honey removes that advantage entirely. It doesn’t turn you into a bargain hunter — it simply ensures you’re not paying a “convenience tax” for shopping fast.

2. Rakuten – Quietly Getting Paid for Spending You’d Do Anyway

Rakuten works on a simple but powerful principle: retailers are already willing to give money back — they just don’t advertise it clearly. Instead of offering upfront discounts, many brands allocate marketing budgets for cashback partnerships. Rakuten passes a portion of that money back to you.

You shop through Rakuten’s app or browser extension, buy exactly what you planned to buy, and earn a percentage back. Over time, these small percentages compound into real, tangible money — often without the user feeling like they “saved” at all.

What makes Rakuten especially effective is that it doesn’t interfere with decision-making. You’re not pressured to buy specific items or brands. You’re simply redirected through a portal that tracks your purchase.

Why this matters:

Many people budget carefully yet still feel like their money disappears. Cashback fills that gap. It doesn’t restrict spending — it reclaims value that would otherwise stay with the retailer.

3. Capital One Shopping – Catching Overpriced Purchases Before Regret Sets In

Capital One Shopping excels at something most people don’t have time for: real-time price comparison across multiple retailers. When you’re viewing an item, the extension checks if the exact same product is available elsewhere for less — often from stores you wouldn’t think to search manually.

It also keeps track of price history, which is crucial for items like electronics, appliances, or home goods. Many prices cycle predictably, but without historical context, it’s hard to know whether you’re buying at a peak or a dip.

Capital One Shopping can even notify you when prices drop after you’ve shown interest in an item, helping you avoid impulse purchases driven by artificial urgency.

Why this matters:

Overpaying often happens because comparison feels exhausting. This app removes friction from the process, allowing you to make informed decisions without turning shopping into a research project.

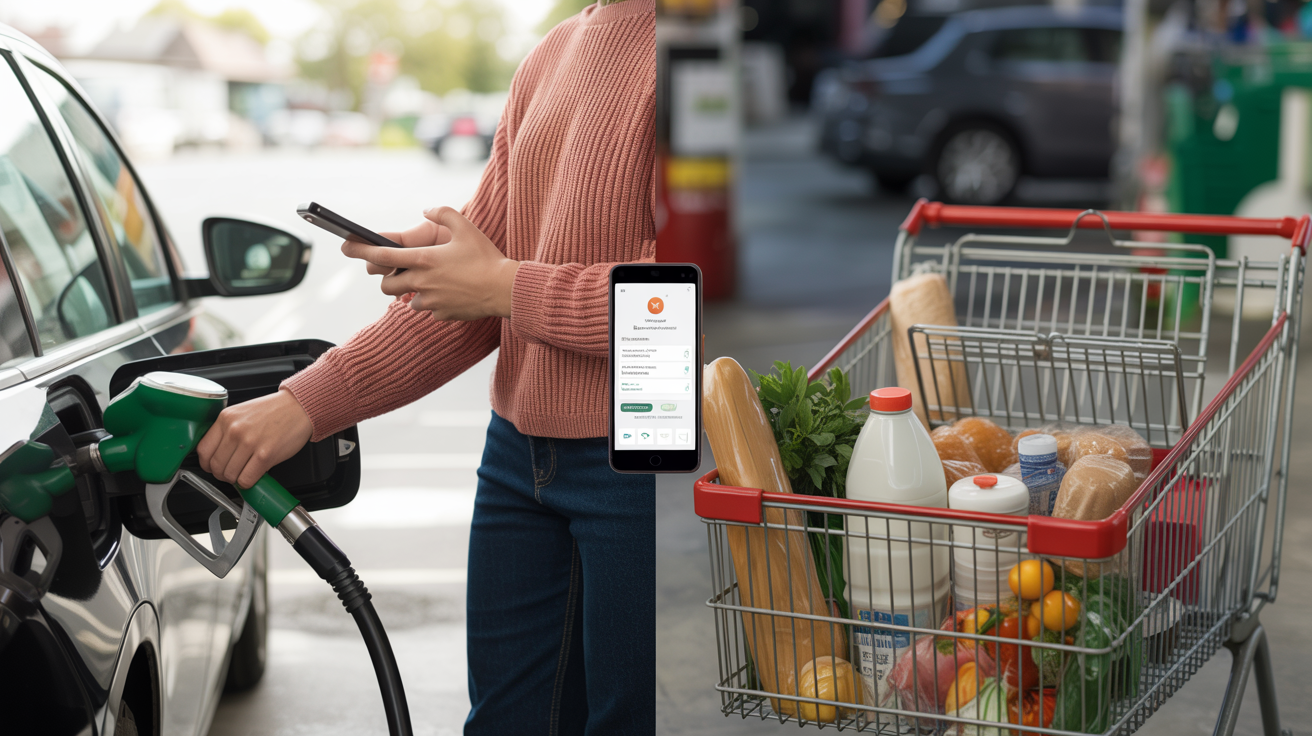

4. GasBuddy – Taking the Guesswork Out of Fuel Costs

Gas prices are one of the most volatile everyday expenses, yet most drivers treat them as unavoidable. GasBuddy challenges that assumption by showing real-time fuel prices reported by users at stations near you.

The differences between stations can be surprisingly large — even within the same neighborhood. Over weeks and months, choosing slightly cheaper stations can save far more than people expect, especially for commuters or frequent drivers.

GasBuddy also offers route-based price tracking, which is useful when traveling or planning longer drives. Instead of stopping at the most convenient station, you can stop at the smart one.

Why this matters:

Fuel is a recurring cost with little emotional attachment. Small optimizations here don’t feel restrictive, but they significantly reduce long-term spending.

5. Ibotta – Making Grocery Inflation Hurt Less

Groceries are where many people feel financially defeated. Prices rise quietly, packaging shrinks, and weekly totals creep upward even when buying the same items. Ibotta helps counter that by offering cash back on everyday grocery purchases.

Instead of clipping coupons or switching stores constantly, you activate offers in the app and shop as usual. Afterward, you scan your receipt or link your loyalty account, and cash back is deposited into your Ibotta balance.

Unlike store-specific promotions, Ibotta works across many retailers and even supports online grocery orders. That flexibility makes it easier to use consistently — which is where the real savings happen.

Why this matters:

Ibotta doesn’t fight inflation, but it reduces its impact. It gives back a portion of money on necessities, helping groceries feel less overwhelming over time.

Why These Apps Work When Budgets Fail

Traditional budgeting focuses on discipline and restriction — cutting back, saying no, and constantly monitoring yourself. These apps work because they address a different problem: inefficiency.

They:

-

Prevent price blindness

-

Catch invisible markups

-

Reduce decision fatigue

-

Protect money before it’s spent

Instead of asking you to change who you are, they adapt to how you already live.

Paying the Right Price Is a Skill — Not a Personality Trait

You don’t need to be frugal, obsessive, or ultra-organized to stop overpaying. You just need systems that work quietly in your favor. These apps don’t promise extreme savings overnight — they offer something better: consistency.

Over time, paying the right price becomes your default, not your exception. And that shift — subtle as it seems — is what creates real financial breathing room.

Read next: 10 Money Habits of People Who Are Actually Rich (And How You Can Build Them Too)