Buying Out-of-Season Helped Me Spend Smarter All Year

It’s funny the things you remember. I can still picture a particular winter coat I bought years ago. It was a beautiful, deep blue wool, and I’d spotted it in a department store window right as the first chill of November hit the air. I needed a new coat, or at least, I’d convinced myself […]

Why I Avoid “Buy One, Get One Free” Deals Now

For years, the words “Buy One, Get One Free” were like a siren song to me. They whispered promises of smart shopping, of doubling my bounty for half the effort, of being a savvy consumer who knew how to work the system. I’d walk into the grocery store, my eyes scanning the aisles for those […]

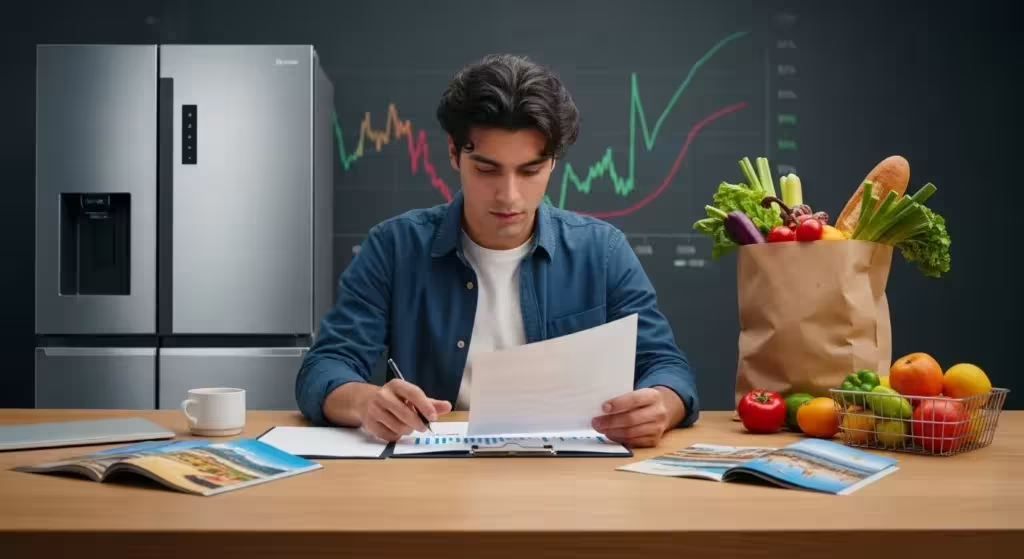

How Consumer Spending Drives the Market (and What Slows It Down)

Welcome! Understanding the forces that shape our economy can feel complex, but it doesn’t have to be. One of the most powerful engines driving the economic world around us is something we all participate in every day: consumer spending. Whether it’s buying groceries, planning a vacation, or investing in a new appliance, our collective purchasing […]

12 Must-Know Shopping Hacks That Save You Money Every Time

We all appreciate getting the best value for our hard-earned money. Whether you’re managing a household budget, saving for a special trip, or simply enjoy the satisfaction of a smart purchase, knowing how to shop wisely can make a significant difference. Over the years, many of us have developed keen instincts for finding a good […]

How I Saved My First $1,000 on a Minimum Wage Job

The memory is still so vivid, even after all these years. The crisp, new hundred-dollar bill I held in my hand felt heavier than any amount of money I’d ever touched. It wasn’t just a bill; it was a symbol. It was the culmination of months of sacrifice, of learning, and of a quiet determination […]

10 Psychological Tricks Stores Use to Make You Spend More

Many of us have spent years honing our shopping skills, becoming savvy consumers who know how to find a good deal and stick to a budget. We understand the value of a dollar and appreciate quality. However, retailers are also very skilled – they employ a fascinating array of techniques rooted in shopping psychology and […]

How Inflation Changed the Way I Grocery Shop in 2025

It feels strange to say it, but the year 2025 completely reshaped something as fundamental as how I buy food. Before then, grocery shopping was a routine, almost thoughtless task. I had my favorite brands, my usual stores, and while I wasn’t extravagant, I didn’t meticulously track every single penny spent on food. My retirement […]

One Year I Used Only Discounted Gift Cards for Gifting—Here’s What I Learned

It all started, as many financial resolutions do, with a slightly queasy feeling after a particularly extravagant holiday season. I remember sitting amidst a mountain of discarded wrapping paper, looking at my credit card statement preview online, and thinking, “There has to be a better way.” It wasn’t that I regretted the generosity, not at […]

Top 10 Market Movers After the Latest Fed Interest Rate Decision

Welcome to Pocket Watch, your trusted source for understanding the financial world. Today, we’re diving into a topic that often makes headlines and can seem a bit complex: the Federal Reserve’s interest rate decisions and how they shake up the stock market. Many of us are keeping a close eye on our investments and savings, […]