A Realistic Millionaire Challenge for People Starting From Scratch

Becoming a millionaire sounds like one of those goals people whisper about but rarely plan for seriously. It’s often wrapped in myths—inheritance, luck, crypto miracles, or extreme deprivation. The truth is far less dramatic and far more empowering.

Most self-made millionaires didn’t win big overnight. They followed a set of habits, systems, and decisions over time. That’s why framing wealth-building as a challenge works so well—it turns a vague dream into a series of clear, repeatable steps.

This “How to Become a Millionaire Challenge” isn’t about getting rich fast. It’s about building the mindset, structure, and financial momentum that make becoming a millionaire inevitable.

Let’s break it down.

Step 1: Redefine What “Millionaire” Actually Means

Before touching money, you need clarity.

A millionaire is not:

-

Someone who spends wildly

-

Someone with luxury cars and zero savings

-

Someone who looks rich online

A real millionaire is someone whose net worth (assets minus liabilities) is at least $1 million.

That means:

-

Cash

-

Investments

-

Retirement accounts

-

Businesses

-

Real estate

Minus: -

Debt

-

Loans

-

Credit card balances

Challenge task:

Calculate your current net worth—even if it’s uncomfortable. Awareness is power. You can’t grow what you refuse to look at.

Step 2: Stop Leaking Money (The Silent Wealth Killer)

Most people don’t fail to become millionaires because they don’t earn enough. They fail because their money leaks out unnoticed.

These leaks often look like:

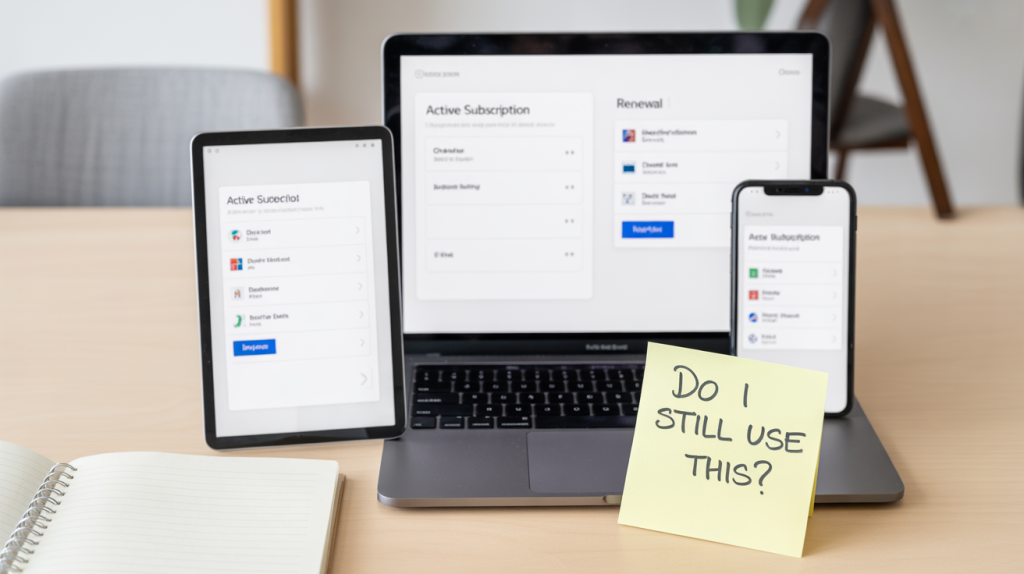

-

Subscriptions you barely use

-

Convenience spending (food delivery, impulse buys)

-

Lifestyle inflation after every raise

-

Emotional spending as a coping mechanism

This isn’t about guilt. It’s about control.

Challenge task:

Track every expense for 30 days. Not roughly. Not “mentally.” Actually write it down or use an app. Patterns will reveal themselves fast.

Most people find at least 10–20% of their income is leaking without intention.

Step 3: Build a “Millionaire Buffer” First

Before investing, hustling, or dreaming big, you need stability.

That means:

-

An emergency fund (3–6 months of expenses)

-

No reliance on credit cards for survival

-

The ability to say no to bad opportunities

Wealth grows best when you’re not in panic mode.

Challenge task:

Your first mini-goal is not $1 million—it’s $1,000 saved, then $5,000, then $10,000. Momentum matters more than scale.

Step 4: Increase Income (This Is Non-Negotiable)

You cannot budget your way to a million on a low income. At some point, earning more becomes essential.

Millionaires almost always:

-

Have multiple income streams

-

Negotiate pay instead of accepting it

-

Monetize skills, not just time

This doesn’t mean burning out. It means being strategic.

Examples:

-

Freelancing alongside a full-time job

-

Starting a niche blog or content brand

-

Consulting in something you already know

-

Selling digital products or services

-

Investing in skills that pay more over time

Challenge task:

Ask yourself: “What skill do I already have that someone would pay for?”

Then research how people are monetizing that exact skill right now.

Step 5: Learn the Basics of Investing (You Don’t Need to Be a Genius)

Most millionaires are not investing experts. They’re consistent investors.

The key principles:

-

Start early (time beats timing)

-

Invest regularly, not emotionally

-

Keep fees low

-

Don’t chase hype

Common millionaire vehicles:

-

Index funds

-

Retirement accounts

-

Real estate (eventually)

-

Businesses or equity in businesses

You don’t need to understand everything. You just need to understand enough to start.

Challenge task:

Open an investment or retirement account (if you don’t already have one). Automate contributions—even if it’s a small amount.

Consistency compounds faster than motivation.

Step 6: Avoid the “Fake Rich” Trap

One of the biggest obstacles to becoming a millionaire is trying to look like one too early.

This includes:

-

Buying status items to impress others

-

Upgrading lifestyle before income is stable

-

Measuring success by appearances

Real millionaires often:

-

Drive cars they could replace in cash

-

Delay gratification

-

Spend intentionally, not impulsively

Wealth is quiet. Debt is loud.

Challenge task:

Before any big purchase, ask:

“Is this helping future me—or just current me’s ego?”

Step 7: Use Time as a Wealth Tool

Millionaires think in decades, not months.

They understand:

-

Small actions repeated daily outperform dramatic bursts

-

Compounding works for habits, not just money

-

Boring consistency wins

Saving $500 a month invested wisely over 30 years can lead to seven figures—not because of magic, but because of time.

Challenge task:

Create one “non-negotiable” money habit you commit to for the next year. One is enough.

Step 8: Master Your Psychology Around Money

This is where most challenges fail.

If you believe:

-

“Money is hard to keep”

-

“Rich people are lucky or unethical”

-

“I’ll never get ahead anyway”

You will sabotage progress subconsciously.

Millionaires often reframe money as:

-

A tool

-

A resource

-

A multiplier of impact and freedom

They don’t worship it—but they don’t avoid it either.

Challenge task:

Write down your most common money thoughts. Question them. Ask where they came from—and whether they’re actually true.

Step 9: Surround Yourself With Growth Signals

You don’t need millionaire friends. You need millionaire inputs.

This means:

-

Reading about money regularly

-

Following people who talk about building, not flexing

-

Learning how others think about risk, patience, and value

Your environment shapes your financial behavior more than motivation ever will.

Challenge task:

Replace one hour of passive scrolling per week with learning about money, investing, or business.

Step 10: Play the Long Game (This Is the Real Challenge)

The biggest secret of becoming a millionaire is boring—and powerful:

Don’t quit too early.

Most people stop right before momentum kicks in:

-

They stop saving when progress feels slow

-

They stop investing during downturns

-

They abandon side projects before traction

Millionaires are often just people who stayed in the game longer.

Challenge task:

Commit to a 5-year plan. Not a perfect plan—just one you won’t abandon the moment it gets uncomfortable.

The Millionaire Challenge Is a Lifestyle Shift

Becoming a millionaire isn’t about one dramatic decision. It’s about hundreds of small, aligned choices made consistently.

You don’t need:

-

Extreme discipline

-

A perfect background

-

Insider knowledge

You need:

-

Awareness

-

Structure

-

Patience

-

A willingness to grow into the person who can handle wealth

Treat this as a challenge—not to rush, but to stay intentional.

Because wealth doesn’t reward urgency.

It rewards consistency.

Read next: Money Tips After Divorce: What No One Prepares You For (But Everyone Googles)