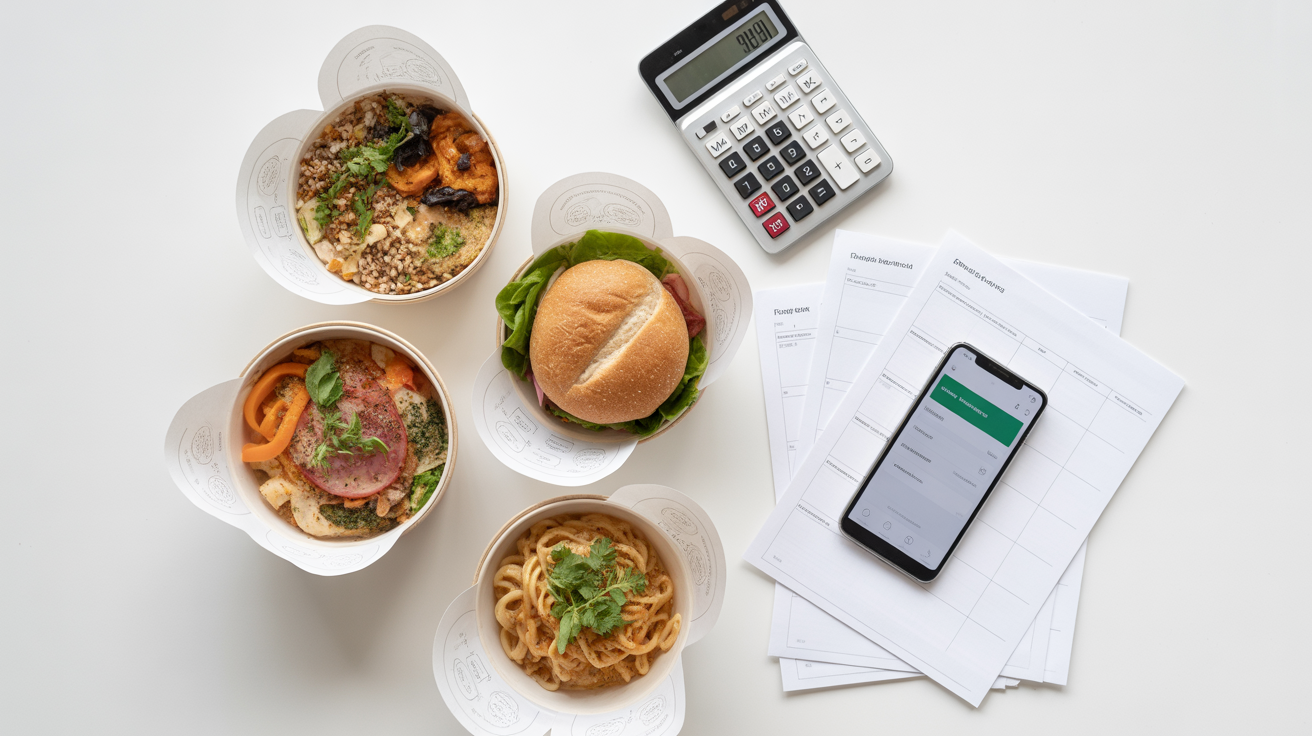

How a “small” habit quietly reshapes your budget, your routines, and your financial future

Ordering takeout three times a week rarely feels like a problem. In fact, for many people, it feels like a reasonable balance between cooking at home and enjoying life. You’re not eating out every day. You’re not splurging on fine dining. You’re simply getting through busy weeks, long workdays, emotional fatigue, and decision overload.

But when you slow down and truly examine what this habit costs—not just weekly, but monthly and yearly—you start to see a different picture. One that explains why so many people feel like they earn “decent money” but still never feel financially comfortable.

This article expands the full story behind takeout 3 times a week: the math, the hidden fees, the emotional triggers, and the long-term trade-offs most people never consciously choose.

Why “Only 3 Times a Week” Feels So Reasonable

Three times a week sounds moderate because it is moderate on the surface. It doesn’t raise alarm bells. It doesn’t feel indulgent. It sits comfortably in the middle zone where habits don’t get questioned.

Culturally, takeout has been normalized as part of modern life. Long commutes, dual-income households, burnout culture, and digital convenience have reframed restaurant food as a practical solution instead of a luxury. When everyone around you is doing it, the behavior stops feeling like a choice and starts feeling like a default.

The danger is not the frequency itself—but how invisible the cost becomes when the habit blends seamlessly into routine.

The Actual Numbers Most People Never Add Up

Let’s look at a realistic example for a single adult living in the U.S.:

-

Average takeout order: $28

-

Orders per week: 3

That doesn’t sound extreme. But consistency is powerful.

Weekly Cost

$28 × 3 = $84

Monthly Cost

$84 × 4.33 weeks = $364

Yearly Cost

$364 × 12 = $4,368

What makes this number shocking isn’t just its size—it’s how quietly it accumulates. There’s no single moment where you “feel” the $4,368 leaving your life. It disappears in pieces too small to emotionally register, yet large enough to permanently weaken your financial foundation.

The Costs You Never See on the Menu

Most people mentally calculate takeout based on the food price alone. That’s where the real underestimation begins.

Delivery Platforms Multiply the Bill

Apps like DoorDash, Uber Eats, and Grubhub layer costs in a way that feels fragmented but adds up fast. Between delivery fees, service fees, small-order fees, and regional surcharges, your final total can be 20–35% higher than the food itself.

Because these fees are broken into categories, your brain doesn’t register them as one large cost. You just see “checkout” and move on.

Tipping Becomes a Silent Annual Expense

Tipping feels optional, but socially it isn’t. Most people tip automatically, even when money is tight, because it’s tied to values and guilt rather than budgeting.

A $5 tip doesn’t feel like much—until you multiply it by 150+ orders a year. Suddenly, you’ve spent hundreds of dollars not on food, but on obligation. And because tipping isn’t tracked as a category for most people, it remains financially invisible.

Inflated App Prices vs Real Restaurant Prices

Many restaurants raise menu prices on delivery apps to compensate for platform commissions. That means the food itself costs more before fees and tips are even added.

You might think you’re paying $15 for a meal—but the same dish might be $12 if ordered in person. Over time, that hidden markup quietly drains your budget without offering any additional value.

The Add-On Effect Nobody Plans For

Takeout encourages impulse additions. Drinks, sides, desserts, “just in case” extras. These aren’t decisions you carefully weigh—they’re emotional add-ons made when you’re already tired.

At the grocery store, you might skip a $4 soda. On an app, it feels negligible. But when these extras show up multiple times a week, they become a pattern, not a treat.

Is Takeout Really Buying You Time?

The most common justification for takeout is time. People believe they’re trading money for convenience—and sometimes that’s true. But often, takeout isn’t replacing elaborate home cooking. It’s replacing simple meals.

A 10–15 minute dinner at home—eggs, pasta, frozen vegetables, rice and protein—gets replaced with a 30–45 minute wait and a $30 bill. The time saved is minimal, but the money spent is significant.

When examined honestly, many takeout orders are less about time and more about decision fatigue and emotional exhaustion.

What That Money Could Have Done Instead

$4,368 per year isn’t abstract—it’s deeply practical.

That amount could:

-

Fully fund an emergency savings buffer

-

Cover several months of groceries

-

Pay down high-interest credit card debt

-

Absorb rent or utility increases without stress

-

Seed an investment or retirement account

-

Finance a meaningful trip or personal milestone

Instead, it leaves no trace. No asset. No memory. No long-term improvement to your life.

The Emotional Loop Behind Frequent Takeout

Takeout is rarely just about hunger. It’s often a coping mechanism.

People order food when they’re overwhelmed, lonely, overstimulated, or emotionally drained. The act of ordering becomes a reward—a way to say, “I survived today.”

But the relief is short-lived. The cost remains. And over time, the habit loses its pleasure while keeping its price tag.

This is how people end up spending luxury-level money on something that no longer feels luxurious.

Why It’s Harder to Cut Than Other Expenses

You can cancel subscriptions in seconds. You can switch phone plans. You can shop cheaper brands.

Food is different. It’s daily. It’s emotional. It’s tied to comfort and care.

When people try to eliminate takeout entirely, they often fail—not because they lack discipline, but because they didn’t replace the function takeout served in their lives.

Convenience doesn’t disappear just because you set a rule.

A Realistic Way to Reduce Without Feeling Deprived

The goal isn’t to punish yourself. It’s to regain awareness and control.

Reduce Frequency, Don’t Ban It

Dropping from three times a week to once a week can cut annual spending by over $2,500—without eliminating joy.

Build an “Emergency Food System”

Stock your home with meals that require almost no energy. When cooking feels impossible, these meals compete with takeout on convenience.

Make Ordering a Conscious Choice

Ask yourself one question:

Would I still order this if it cost 20% more?

If not, it’s probably impulse—not intention.

Track One Month—Just One

Seeing the number in writing changes behavior faster than guilt or discipline ever will. Awareness creates natural restraint.

Takeout Isn’t the Problem—Automation Is

There is nothing wrong with enjoying restaurant food. The issue begins when ordering becomes automatic, frequent, and emotionally driven.

Three times a week feels harmless. Over a year, it becomes one of the largest discretionary expenses in a household—often without people realizing it.

Small Choices Build Big Financial Outcomes

No one ruins their finances with one dramatic decision. They do it through dozens of small, unexamined habits that feel normal.

Takeout isn’t about food.

It’s about attention.

Once you see where the money is going, you get to decide—intentionally—what your income supports next.

And that choice is where financial freedom quietly begins.

Read next: Why Americans Spend More on Convenience Food Than Groceries