Why the Shortfall is Hitting So Hard

Part of the challenge is simple: costs keep rising, and most retirees didn’t anticipate just how steep things would get.

-

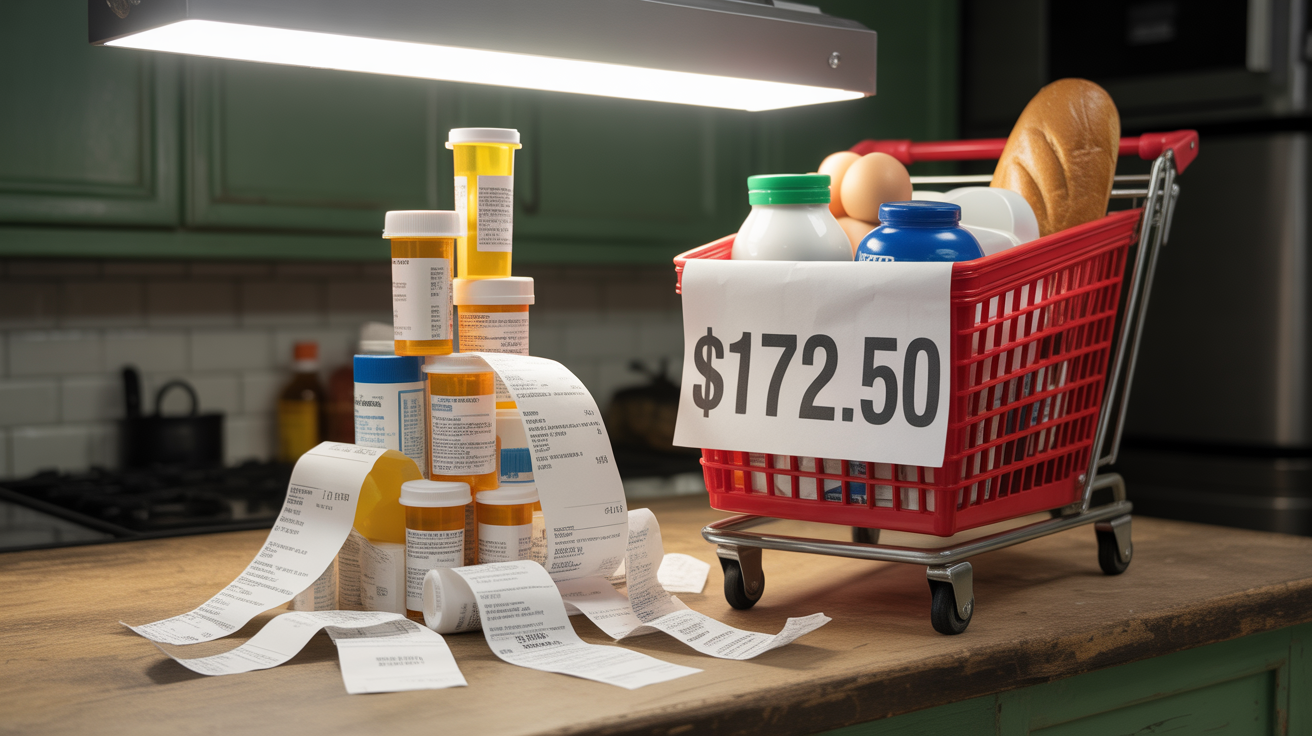

Health care costs alone are projected at about $172,500 for a 65-year-old retiring this year — and that’s per person, not per couple.

-

Everyday living — food, gas, housing, insurance — is more expensive than it was even five years ago.

-

Inflation, though cooling slightly, has still eaten into fixed incomes and conservative investments.

On top of that, many retirees leaned on old “rules of thumb” for retirement planning — like the idea that you could safely withdraw 4% of your nest egg every year and be fine. In today’s environment, that doesn’t always hold true.

Is There a “Magic Number” for Retirement?

You’ve probably seen headlines shouting that you need $1.26 million to retire “comfortably” in the U.S. These numbers make for good attention-grabbers, but here’s the truth: there is no universal magic number.

How much you need depends on:

-

Your health and life expectancy

-

Your lifestyle choices

-

Where you live (a retiree in Kansas will spend far less than one in California)

-

How well you manage taxes, inflation, and hidden costs

What matters more than chasing a giant “target” is being brutally honest about your own expenses, income streams, and how long you might need those resources to last.

Here are the moves that can help you stretch your savings, protect your future, and feel more in control.