Trump’s Move to Fire Fed Governor Shakes U.S. Economy (and Your Wallet)

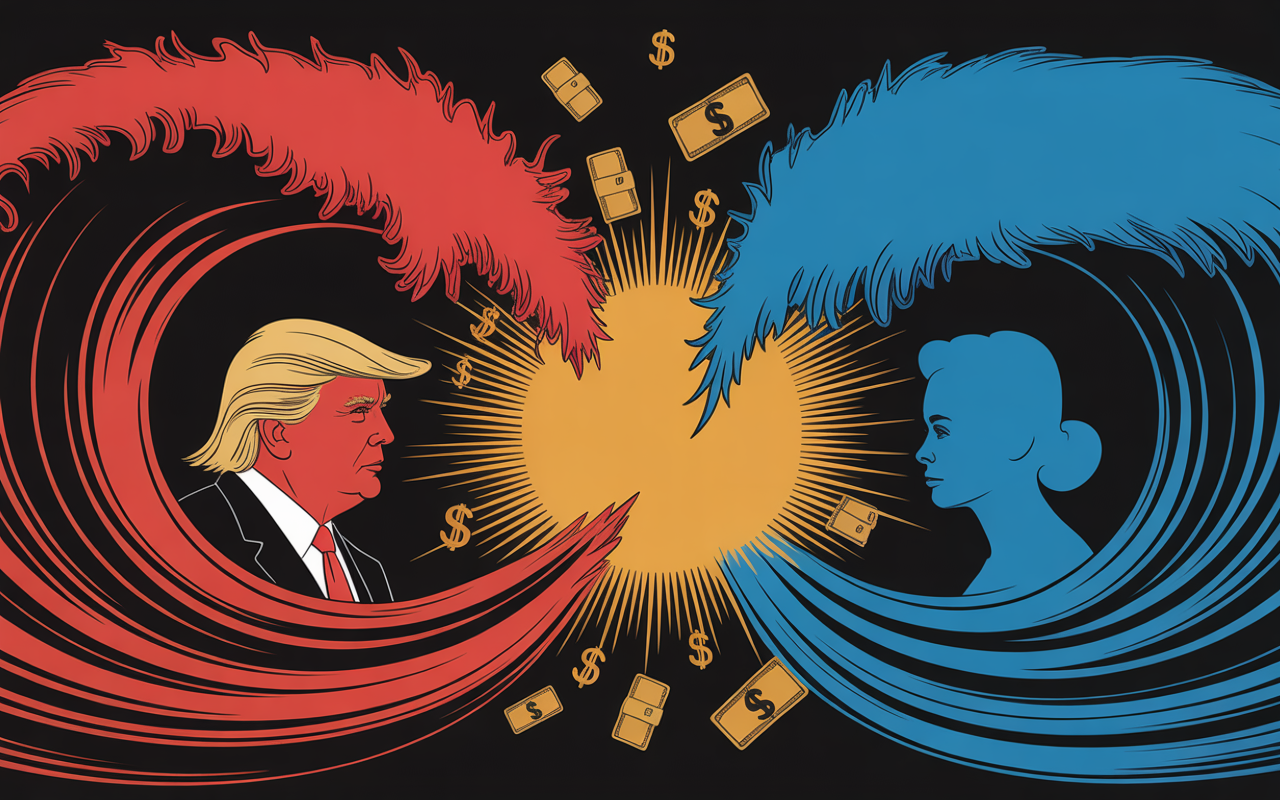

In a move without precedent in the history of the U.S. central bank, Donald Trump has announced his intention to fire Federal Reserve Governor Lisa Cook, triggering immediate turmoil in global markets and raising profound questions about the future of the American economy. The announcement, based on allegations of mortgage fraud, represents a direct challenge to the Federal Reserve’s long-standing independence and carries significant implications for your money—from loans and savings to retirement accounts.

While the original article outlined the immediate risks, a deeper dive into the legal, historical, and economic context reveals why this move could have consequences that stretch for years, fundamentally altering the financial landscape for every American.

Expanded Breakdown: The Dollar, Your Debt, and the Domino Effect

The market’s reaction to the news was swift and severe, a direct reflection of the uncertainty unleashed by the move.

Markets in Turmoil: As the news broke, reports indicated stock futures declined and the U.S. dollar weakened against other major currencies. This immediate panic reflects investor fears that the Federal Reserve, long seen as a stable and independent institution, could become subject to political whims. A loss of confidence in the Fed’s ability to control inflation without interference could lead to a sustained sell-off of U.S. assets.

The Real Cost of Borrowing: For consumers, this instability translates directly into higher costs. An effort to remove a Fed governor is likely to cause bond yields to spike. Because yields on government bonds are the benchmark for most consumer loans, this means you could face:

Pricier Mortgages: Higher bond yields push mortgage rates up, making it more expensive to buy a home.

Increased Credit Card Rates: The interest on your credit card debt will likely climb, making it harder to pay off balances.

More Expensive Auto and Personal Loans: The cost of financing a car or taking out a personal loan would also rise, squeezing household budgets.

A Constitutional Clash: The “For Cause” Crisis

This is more than a policy disagreement; it’s a legal and constitutional challenge. Federal Reserve governors are appointed for 14-year terms specifically to insulate them from short-term political pressure.

Under the Federal Reserve Act, a president can only remove a governor “for cause.” This term has historically been interpreted to mean demonstrable wrongdoing or dereliction of duty, not a disagreement over policy. Trump’s letter to Cook stated he found “sufficient cause” in the mortgage allegations, which were raised by a political ally.

Governor Cook has forcefully pushed back, stating that “no cause exists under the law, and he has no authority” to remove her. Her legal team has vowed to take action to prevent what they deem an “attempted illegal action.” This sets the stage for a protracted legal battle that could reach the Supreme Court, creating a cloud of uncertainty over the central bank’s leadership and decisions for months or even years.

Your Retirement and the Threat of Long-Term Inflation

The independence of the Federal Reserve is the bedrock of global confidence in the U.S. dollar. For decades, investors worldwide have trusted that the Fed would do what is necessary to control inflation, even if it meant making unpopular decisions like raising interest rates. This move puts that trust at risk.

Retirement Accounts at Risk: Market volatility is poison for 401(k)s and IRAs. The stock market dips seen immediately following the news are a preview of what could happen if uncertainty persists. If investors, particularly those overseas, begin to view U.S. assets as politically risky, they may pull their money out, leading to broader market declines and shrinking your retirement portfolio.

The Return of 1970s-Style Inflation: History offers a stark warning. In the 1970s, President Richard Nixon successfully pressured Fed Chair Arthur Burns to keep interest rates low to boost his re-election campaign. The result was a decade of painful, runaway inflation that devastated savings and required brutally high interest rates later to correct. Economists widely agree that a central bank free from political pressure is the best defense against a repeat of this scenario.

If the Fed is perceived as being under the president’s control, its credibility in fighting inflation could collapse, leading to higher prices on everything from groceries to gasoline.

Why This Matters Beyond the Headlines

The stability of your personal finances relies on the stability of the broader economy. An independent Fed provides that foundation.

For Savers and Retirees: If the Fed is pressured to keep interest rates artificially low to boost short-term growth, inflation will erode the value of your savings. For retirees on a fixed income, this means their Social Security and pension checks will buy less each month.

For Families and Businesses: An unstable economic environment makes it harder for businesses to plan, invest, and create jobs. This can lead to slower wage growth and fewer opportunities. For families, unpredictable interest rates and rising prices make it nearly impossible to budget for the future.

What You Should Consider Now

While the situation is fluid, the core principles of sound financial management are more important than ever.

- Stay Diversified: The original advice holds true. Ensure your investments are spread across various asset classes to buffer against volatility in any single area.

- Maintain an Emergency Fund: Having three to six months of living expenses in cash is critical when markets are unpredictable and the economic outlook is uncertain.

- Watch Interest Rates Closely: If you have significant credit card debt, consider consolidating it now before rates potentially rise further. If you are planning a major purchase that requires a loan, locking in a fixed rate sooner rather than later could save you substantially.

- Focus on the Long Term: While headlines can be alarming, making rash decisions with your investments is rarely a good strategy. Stick to your long-term financial plan, but remain aware of the developing economic landscape.

The upcoming Federal Reserve meetings will be under intense scrutiny. The central question is whether the institution can maintain its credibility in the face of this unprecedented political pressure. The outcome will shape not just the markets, but the financial health of every American household.

Read next: The Adviser’s Playbook for Rapid Cash: Ready, Set, Fund